Research Shows Many AAPIs Rely on Family and Friends

In the Absence of Culturally Relevant Financial Services and Products

April 1, 2015 (Los Angeles, CA) – The National Coalition for Asian Pacific American Community Development (National CAPACD) today released Scrimping + Saving, a groundbreaking report that offers both new data and creative solutions for addressing growing financial vulnerability in low-income Asian American and Pacific Islander (AAPI) communities.

The report which was supported by the National Council of La Raza and Citi, highlights how age, ethnicity, immigration status, English language fluency and other variables influence access to financial information, services and products. Findings from the research include:

- Heavy reliance on friends and family to provide financial advice in the absence of reliable, trusted sources. Fifty-six percent (56%) of respondents either did not know where to turn for financial advice, or turned to potentially unreliable sources.

- Twenty-three percent (23%) of respondents were unaware of where or how to obtain emergency funds if needed or were doubtful if they could raise it at all, leaving them vulnerable to predatory financial services like payday lenders.

- Recent immigrants in particular face lower rates of bank account ownership, greater reliance on cash for daily transactions, and an inability to conduct financial transactions in English (36%).

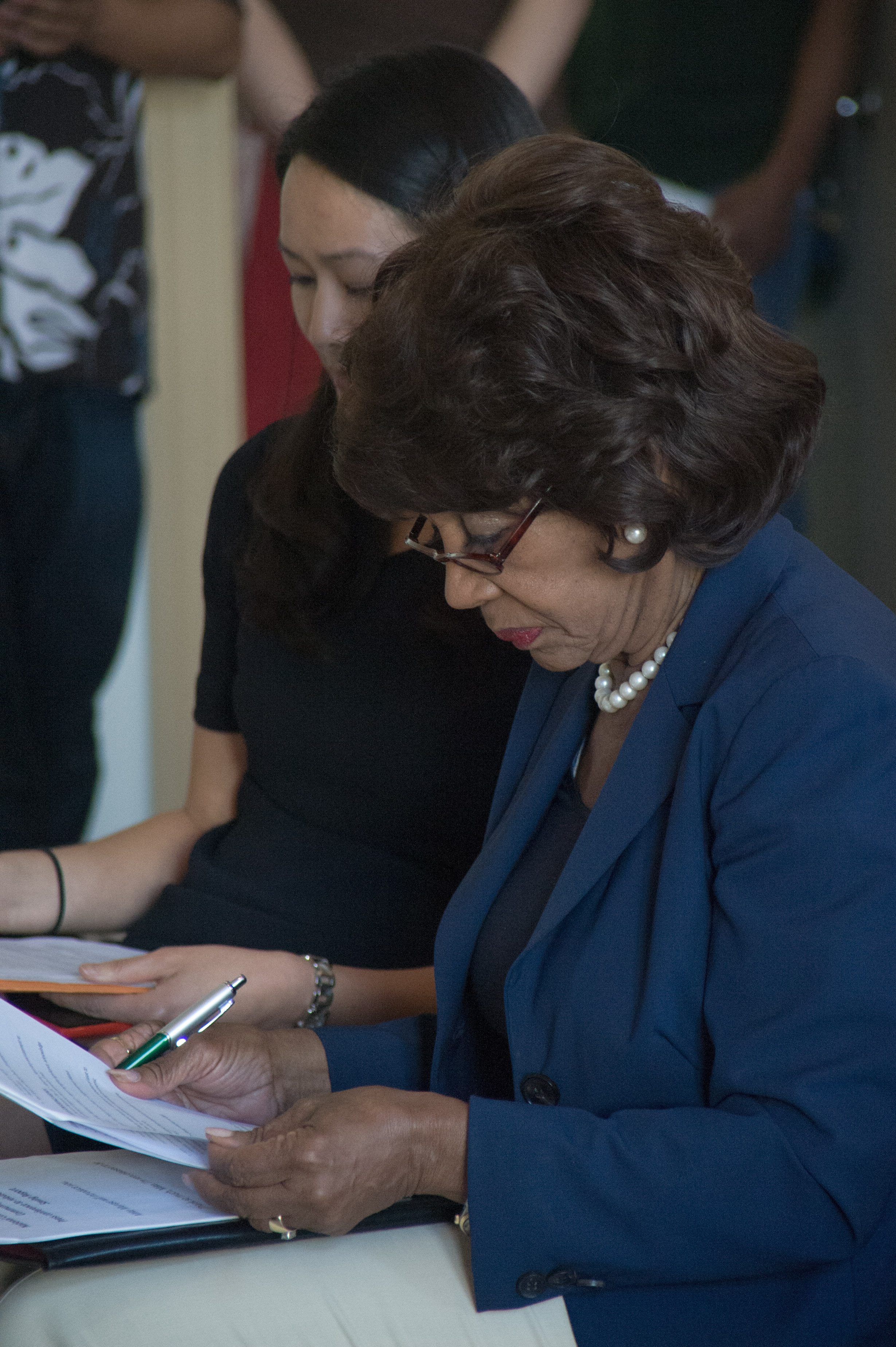

U.S. Congresswoman Maxine Waters (CA-43), Ranking Member of the House Committee on Financial Services, was on hand to release the report and praised the document’s call for greater corporate responsibility, government oversight, and improved regulations that complement and support individual action.

“I am privileged to represent a diverse District filled with individuals from many different racial and ethnic backgrounds. Asian Americans and Pacific Islanders are a significant part of my District’s population, and are growing rapidly across our state and nation,” said Waters. “But like other segments of our community, far too many Asian Americans and Pacific Islanders face significant, cultural and systemic barriers to achieving the American Dream. We must ensure that Washington is focused on the specific needs of all communities facing poverty, through policies that promote safe, affordable services and products for low-income individuals. These reasonable actions will keep our families from falling victim to the predators that simply exacerbate debt, not end it.”

Congresswoman Judy Chu (CA-27), Chair of the Congressional Asian Pacific American Caucus also commented on the significance of the report, stating that, “Asian Americans and Pacific Islanders constitute a diverse community comprised of ethnic subgroups that have some of the highest levels of poverty and the lowest per capita income compared to other populations. This is due in large part to cultural and linguistic hurdles that prevent many AAPIs from accessing financial information, services, and capital. Through the use of disaggregated data, the Scrimping + Saving report provides a clearer understanding of the challenges AAPIs face and offers concrete recommendations for improvement. I commend National CAPACD for releasing this important report, and I look forward to our continued work together to ensure that AAPIs are equipped with the resources they need to achieve financial stability.”

Recommendations outlined in the report include the call for greater innovations in the asset-building field that capitalize on the strength of familial and peer relationships, which are already a trusted resource for many low-income AAPIs. “National CAPACD and our members are deeply committed to increasing financial capability within the AAPI community,” said Jane Duong, National CAPACD’s Director of Programs and Advocacy. “The Scrimping + Saving report will better inform solutions adopted by local community based organizations. Peer lending circles and intergenerational educational approaches, both currently being implemented by National CAPACD’s members, are two examples of new, culturally-relevant approaches with significant potential to bridge access to the financial mainstream.”

Some financial institutions have eagerly embraced the new data and recommendations in an effort to reach underserved markets and promote greater financial inclusion amongst communities of color through strategic investments and partnerships.

“Scrimping and Saving is a critical piece of research that disaggregates data to better understand the diverse needs and challenges in the AAPI community, so that appropriate information, coaching, financial products and services can be designed to expand financial access and capability, supporting individuals and families to achieve their goals,” said Bob Annibale, Global Director of Citi Community Development.

National CAPACD partnered with its member organizations across the country to conduct the study in seven different languages and with 14 different ethnic groups, making Scrimping + Saving the first study of this scope and size to look in-depth at the financial health of this population. Participating organizations include Chhaya Community Development Corporation (Jackson Heights, NY); Chinese American Service League (Chicago, IL); Chinese Community Center (Houston, TX); East Bay Asian Local.

To download the report click here.